I just received a call from 888-373-1969, which showed up on my phone as the JPMorgan Chase, which unsuccessfully attempted to ask me a few "secure questions" to pry information from me, likely to steal my real account. I got out of it relatively early, but want to tell the cautionary tale to anyone who thinks they are immune to scam. You are not. And neither am I. Here's how I got out of it. Stay tune to the end for an additional story without a happy ending, too.

If you’re here because you searched “888 373 1969”(or some other number) or “Chase fraud department call”: REPORT THAT NUMBER. As of this writing, here are a few official numbers I could find from Chase, none of them will match the number that just called you. In any case, here's my story.

The Setup (Nothing felt weird...yet)

I was in the middle of work, doing something completely normal. Before this, I had opened my banking app and transferred 4 digit figure amount of money from my other bank to Chase. Nothing unusual. I’ve done this countless times.

About five minutes later, my phone rang.

Caller ID: JPMorgan Chase

Phone number: 888-373-1969

That should have been the moment I stopped and verified. But I didn’t. I was busy, distracted, and banks do sometimes flag transactions (thought in retrospect, never for this amount, or this particular bank-to-bank transfer). So, I answered.

The Call (Designed to feel routine)

The woman on the line said she was calling from the Chase fraud department. Slightly annoyed, I said " Is it because of my recent transaction from my other bank? Sure, I'll verify. Just happened 5 minutes ago."

This didn’t feel strange at first. However, what I didn’t think through in the moment:

- The amount wasn’t *that* large

- The transfer was between my own accounts

- Chase has never called me mid-transfer like this before, out of many times I've done it monthly.

Still, I stayed on the line, doing the other work simultaneously.

Lesson 1: I should have stopped what I was doing to focus on the call. That way, the odd timing of the call would have occurred to me sooner.

The Questions (This Is the Trap)

Question 1: “Which state was your Social Security number issued in?”

She gave me four multiple-choice options.

I answered: [REDACTED].

Lesson 2: Assume private information like your Social or the state where it was issued is likely already out there. Between data brokers, breaches, and commercial data aggregation, scammers often know more than we’d like to believe.

Question 2: “Which company or organization are you associated with?”

I struggled to understand this question and asked her to repeat it to me 3 times. I couldn't tell if she said "association" or "co-creation".

Finally, I understood the question, and mentioned ArtMap Inc (parent company of HackerNoon) as the answer. Again, this information is definitely out there - as I co-run the company with my husband. We are very public about that.

At this point, I was starting to doubt her, though. Her speech was unclear, English didn’t sound like her first language. That alone doesn’t prove a scam, but it raised my internal alert level.

Lesson 3: scammer is usually skilled at communication and has good English. However, in some rare cases, such as a trainee or lower-level employees, they might fumble words, or have heavy accent. This should raise some red flag.

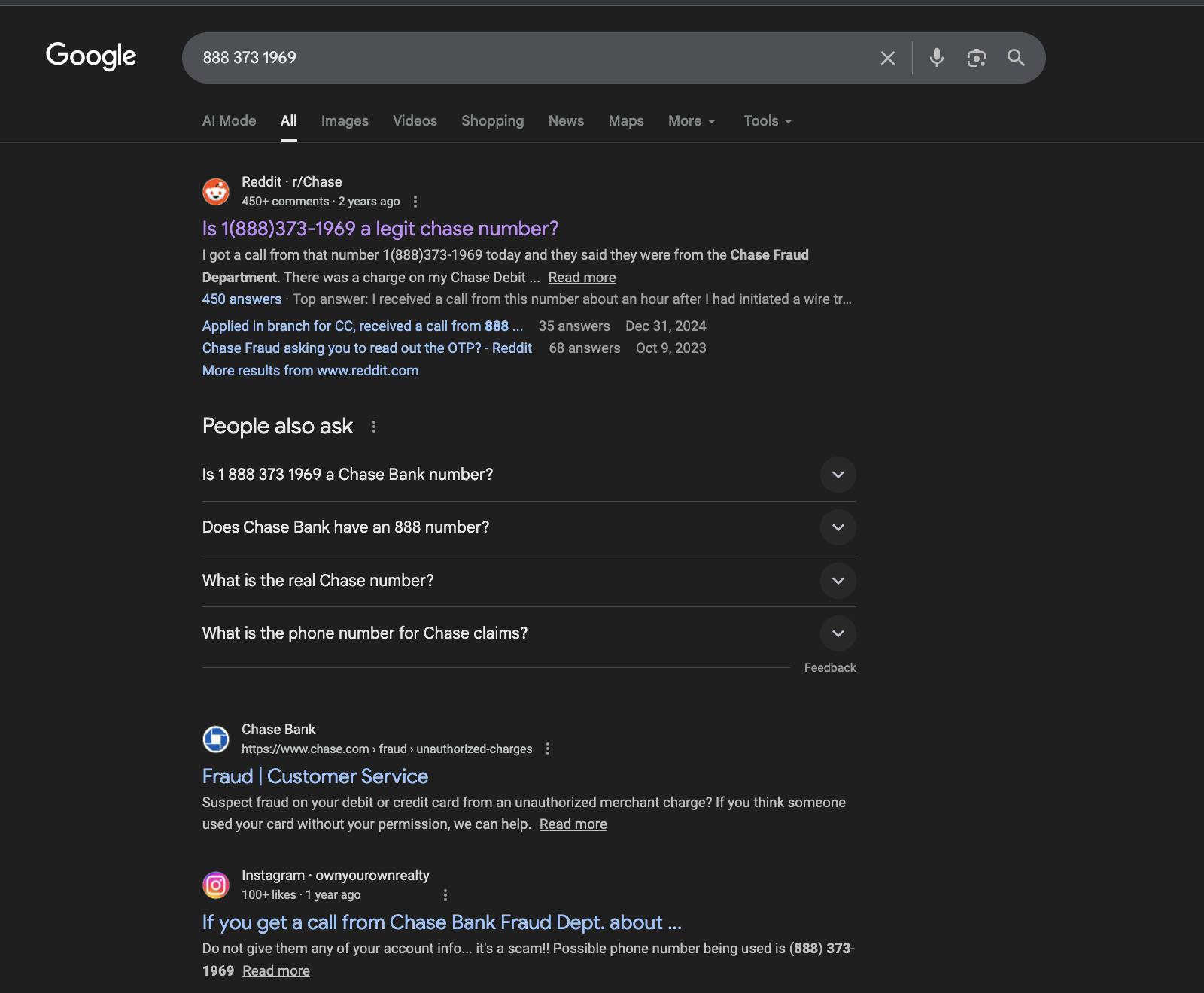

Googling 888-373-1969

While she was still talking, I searched the number 888-373-1969.

This Reddit thread came up immediately:

👉 https://www.reddit.com/r/Chase/comments/10w7kjp/is_18883731969_a_legit_chase_number/

Multiple people described calls from this number claiming to be the Chase fraud department, using nearly identical scripts. Some commenters said Chase had called them before. Others said it was clearly a scam.

That ambiguity is exactly what makes phishing effective. Also, it gave me the idea to write this HackerNoon story afterwards. Nobody actually has written an article yet, only reddit and instagram posts show up.

This was the moment I knew I'm in the middle of a scam (more on this later).

Lesson 4: Always google a number. Sometimes scammers can spoof legit numbers. But the ambiguity should stop you from continuing.

Question 3:“What model is your car?”

This is the part that really matters, as you might have guessed, that question is an actual security question I’ve used before.

If a password or account had already been partially compromised, this is how the scam would’ve finished—one “reasonable” data point at a time.

Instead, I stopped.

I told her: “I know this is a scam. Do something better with your life.”

Then I hung up and blocked 888-373-1969.

Lesson 5: Did you know that you don't always have to answer truthfully to the security question? I learned this tip from a cybersecurity expert years ago at a Ted Conference. What matters is it matches with what you said before, not whether or not it's real.

Postmortem: How It could get much worse

At this point you might think: You didn't even lose anything. Why make a big deal out of a simple phishing scam? People know about these for years now!

Wrong. Let me tell you another story.

A few months ago, a close family member of mine lost almost $17,000 to a more elaborate version of this kind of scams.

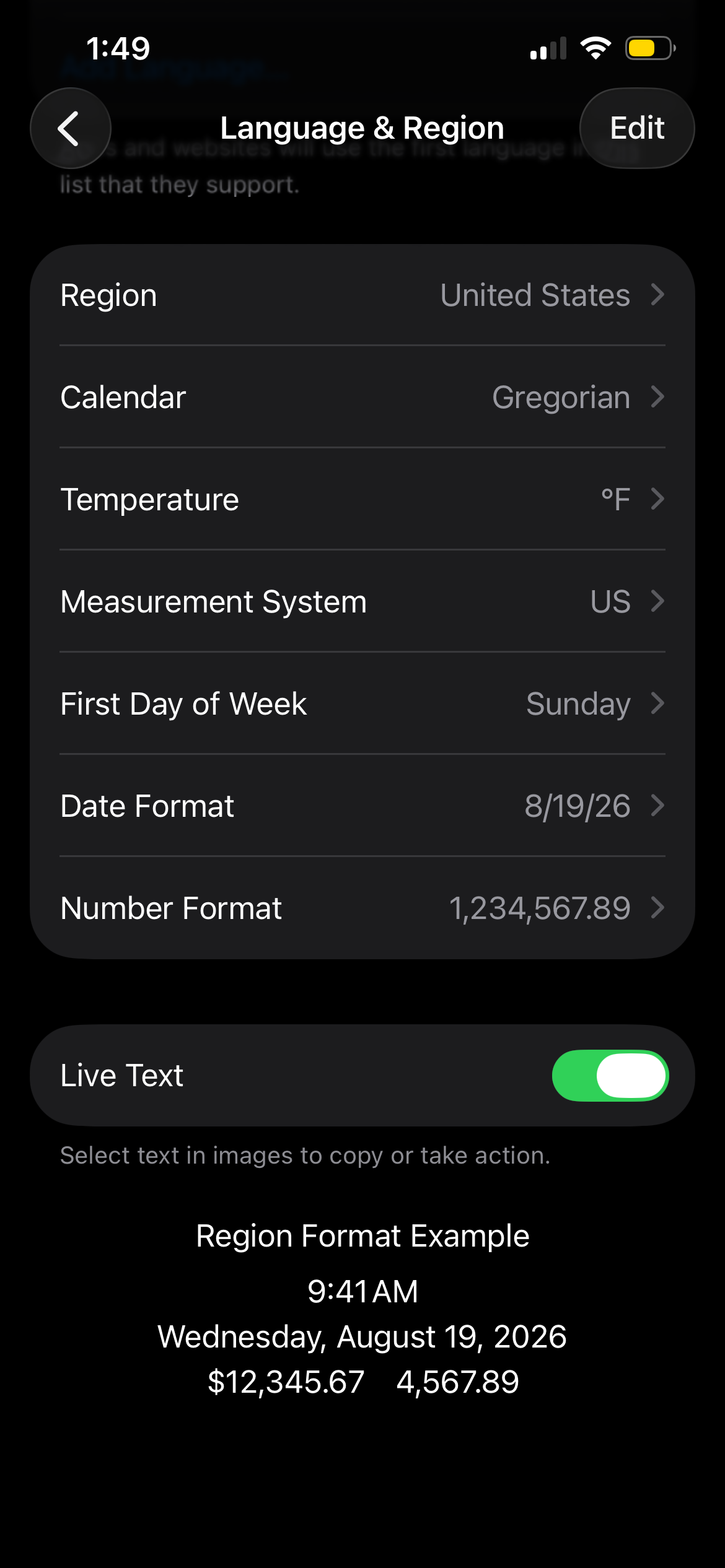

It started with a text that appeared to be from Apple about suspicious activity. She replied as instructed in the text and reported the transaction as fraud. Soon after, she received a call from someone claiming to be Apple support, showing her a live map of where her card had been used and compromised all over the world. They disarmed her by telling her to check her own phone for proof of fraud, a phone settings screen (under Language & Region) showing the exact amount and date they said her account was compromised. What she didn’t know was that this screen is the same on every phone.

By then, she trusted them completely, that her phone has been "hacked". She was instructed to withdraw cash from the bank in the exact amount shown in the phone setting (12k + 4k, equaling almost 17k) to "keep it safe". They instructed her to lie to the bank (because apparently the fraud initiated from her own bank), and to mention to anyone that it was “for construction” if asked why the huge withdrawal. She was isolated from her own family the whole time, being threatened that all the money would be lost if she dropped the phone call. She was then instructed to deposit the cash at an address in town where it would be “secured.” Of course it wasn’t, it was a crypto account.

When she came back home and recited us this whole story, it took her until the very last moment, and us saying "You've been scammed", for her to realize how much she's been bamboozled.

This family member is intelligent, diligent, and cautious. If it happened to her, it could happen to anyone. In fact, here's a story of a Bank CEO getting tangled in cryptocurrency "pig-butchering" scam that made his own bank go under and get him sentenced in prison for 24 years.

The ULTIMATE LESSON : anyone can be spoofed, mind-controlled, and bamboozled. You should assume that information you think is private (phone numbers, companies you’re associated with, home addresses, even Social Security details) may already be out there and used to make scams feel legitimate. Trust, but verify.

Be safe out there. These tactics might be known today. Tomorrow, these criminal organizations (likely operating out of slaves-like conditions in Asia) will have come up with even more sophisticated methods, ones that for example, involve AI. Nobody is immune 100%. The best we could do is to share and alert others. I hope my story in a major publication that I own do a small part in helping others avoid the very real financial AND emotional distress being a victim of scam can create. It takes me writing this whole story down for my heart rate to slow down. It takes my family member a few weeks to recover. Let's hope it's not going to happen to you.